New Ideas For Picking Gold Price Britannia

What Are The Factors I Should Consider When Purchasing Gold Bullion Or Coins For Investment In The Czech RepublicIf you're thinking of investing in gold coins or bullion in the Czech Republic, several factors should be kept in mind- Reliable Source: Buy gold coins or bullion from reliable and trusted sources. Authorized dealers or recognized institutions guarantee authenticity and high-quality.

Check the weight and purity of the gold. Gold is sold in various weights and purity (e.g. 24 Karat, 22 Karat etc.). Make sure it is in compliance with standards for the type of gold you purchase.

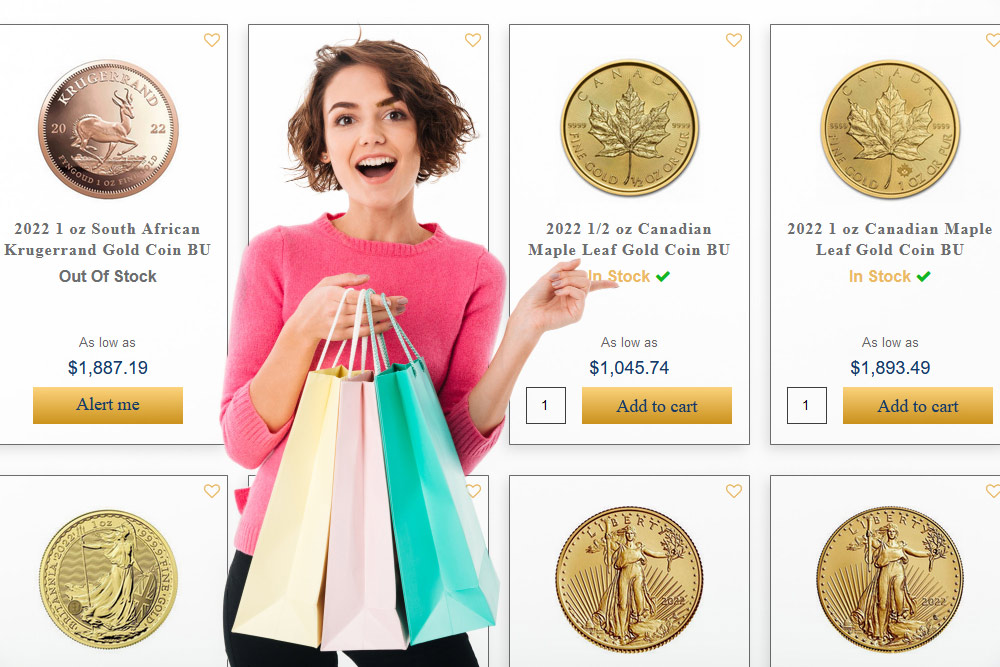

Understanding the price and premiums. This includes understanding the structure of prices for gold, and any premiums levied by dealers. Compare prices to find the most affordable bargain.

Storage and Security: Take into consideration options that are safe and secure for the storage of your gold. Because of security issues, some investors prefer to store their gold at a separate facility or bank.

Liquidity and Selling Options- Take into consideration the ease of being able to sell when you want to. Choose coins or metals that are simple to sell and have high liquidity. See the top rated buy gold bars Czechia examples for blog recommendations including sd bullion gold, gold penny, euro coins, 1oz gold, five dollar gold coin, 2000 sacagawea dollar, cheerios sacagawea dollar, gold silver coins, trade in gold, gold silver coins and more.

How Can I Guarantee The Quality Of Gold That I Purchase In The Czech Republic Or Bullion?

Verifying the legitimacy of gold bullion coins or gold bullion from the Czech Republic requires several steps.-

Certification and HallmarksCheck for official hallmarks or marks on gold objects. These hallmarks, usually issued by trustworthy institutions or assaying offices, confirm the authenticity, weight and quality of the gold. Purity Verification- Verify the gold's purity by checking for marks that indicate the quality or the karatage. In other words 24 karat gold is pure while lower karatages are an indication of different levels of alloying.

Reputable Sellers: Only purchase gold from licensed or reputable dealers. They typically offer authentic certificates as well as receipts which list the specifications for gold.

Get documentation you are purchasing gold, you should request authentic certificates or certificates of assay. These documents must include details about the manufacturer mark, weight, hallmark and the purity.

Independent Verification: Think about getting an appraiser or an expert from a third-party to provide an independent evaluation or confirmation. They can evaluate the authenticity and quality of gold.

Verifying authenticity involves doing the necessary research. Making sure you are buying from reputable sellers and having the right documents is crucial to ensure that you're buying authentic, high-quality bullion. See the top zlatovna.cz precious metals for site info including best gold etf, gold and coin shops near me, double eagles, gold coin values, bullion depository, cheerios sacagawea dollar, investing in gold and silver, silver double eagle coin, gold and bullion, 1979 gold dollar and more.

What Is A Tiny Mark-Up On The Stock Market And A Small Price Spread Of Gold?

In the gold market the low price markup and spread are the expenses involved in purchasing or selling gold when compared to market prices. The terms are used to describe the amount of money you may pay (markup), or the difference in price between the buying and selling price (spread), beyond the price of gold that is market-value. Low Markup- This means that the dealer charges only a small amount of cost over market value. A low markup occurs when the price you are charged for buying gold, is only slightly or barely more than the market price at which it is currently.

Low Spread Price - The spread represents the difference in price between the asking and purchasing price of gold. Low price spreads indicate a small difference between these rates. This means that there is a less difference in the price you pay to buy gold, compared to the price you sell it.

How Much Do Price Differences And Mark-Ups Vary Across Dealers?

Negotiability: Some dealers could be more open to negotiation regarding mark-ups and spreads especially when dealing with larger transactions or returning customers. Geographical Location: Spreads and mark-ups are subject to change according to regional factors such as local regulations, regional laws, and taxes. Dealers that are in regions with high taxes or regulatory costs may pass on the costs to their customers through greater markups.

Types of Products and Availability Markups and spreads differ based on the type of product (coins/bars/collectibles) as well as availability. Due to their rarity or collectibility rare or collectible items might have higher mark-ups.

Market Conditions: In times that are more volatile and also when there is a high demand (or scarcity) dealers could raise spreads to shield themselves from loss or reduce risks.

It is essential for investors, based on these elements that they conduct thorough study to compare prices, and consider other aspects such as reputation, reliability and customer service when choosing the right seller. Comparing prices and obtaining estimates from multiple sources can help you get the best price on gold. See the top buy Bohemia gold bullion for site recommendations including gold coins near me, barrick gold stocks, gold and silver dealers, sacagawea gold dollar, buying gold near me, gold price apmex, buying gold, 1 10 american gold eagle, buy gold silver, 1 oz silver price and more.